The study to Insolvencies

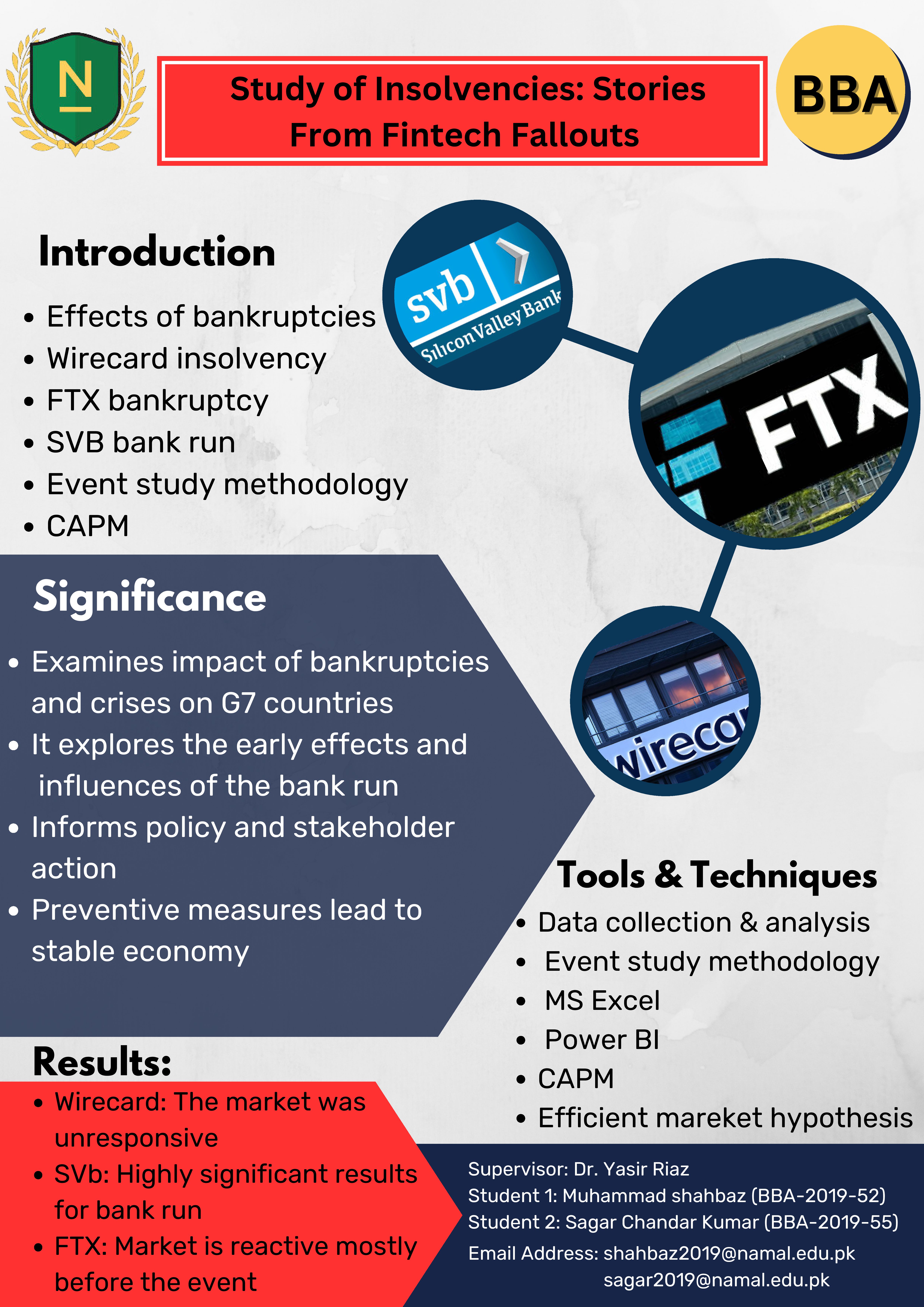

This research examines the impact of bankruptcies and financial crises on various sectors of the economy and the world market. Specifically, the study investigates the effects of the Wirecard insolvency, FTX bankruptcy, and SVB bank run using the Event study methodology. The research aims to understand how such events affect not only the financial sector but also other industries such as technology, non-financials, and the national economy.

The data was collected and analyzed using Microsoft Excel, and the results were visualized through Power BI. The research focused on analyzing the market reaction both before and after the event and the overall impact on the world market average.

The findings of this research suggest that bankruptcies and financial crises have a significant impact on the economy, leading to a ripple effect on various sectors. The study also highlights the importance of early detection and response to such events to mitigate their impact. In a nut shell, this research provides valuable insights into the effects of financial crises on different sectors and emphasizes the need for proactive measures to prevent such events from destabilizing the economy.

Keywords: Event study methodology, Wirecard bankruptcy, FTX bankruptcy, Silicon valley bank, insolvency, financial markets, stock market, market condition

Tools: Data collection, Event study methodology, MS Excel, Power BI

Department: Department of Business Studies

Project Team Members

| Name |

Email |

|

Muhammad Shahbaz

|

Shahbaz2019@namal.edu.pk |

|

Sagar Chandar Kumar

|

Sagar2019@namal.edu.pk |

Project Poster