Connectedness between meme stocks and meme coins

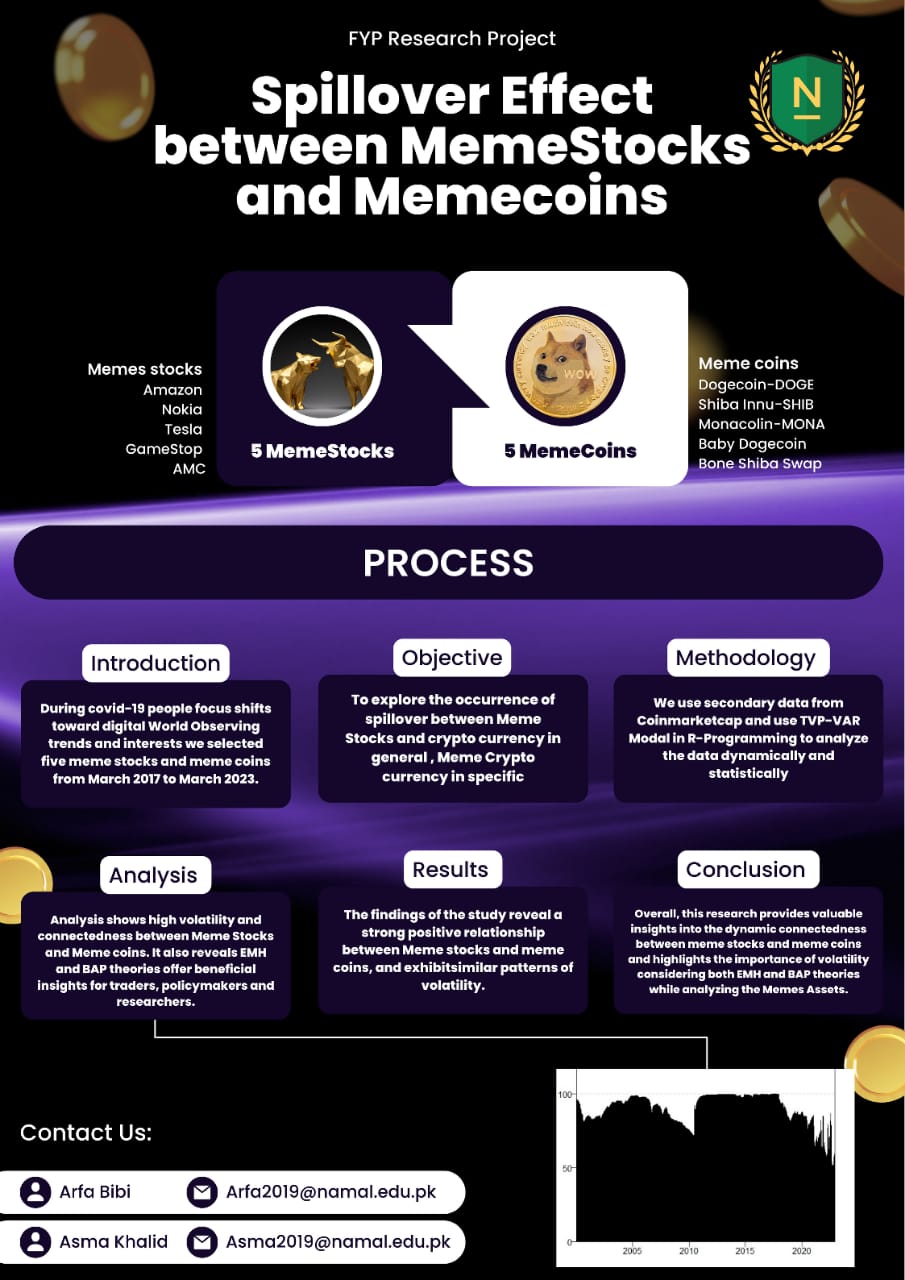

This research aims to investigate the dynamic connectedness between 5 meme stocks (Amazon, Nokia, Tesla, GameStop, AMC) and meme coins (dogecoin, Shiba Inu, MONACOIN,) using a Time-Varying Parameter Vector Auto regression (TVP_VAR) model. The study focuses on the period from January

2017 to March 2022, a time of significant growth and volatility in the meme asset market.

The findings of the study reveal a strong positive relationship between meme stocks and meme coins, with both markets responding to common shocks and exhibiting similar patterns of volatility. The TVP_VAR model shows that the strength of this relationship varies over time, with periods of heightened connectedness followed by periods of decoupling. The analysis also reveals that social media sentiment plays a significant role in driving the relationship between meme assets.

Overall, this research provides valuable insights into the dynamic connectedness between meme stocks and meme coins and highlights the importance of considering both markets when analyzing the behavior of meme assets. The TVP_VAR model provides a powerful tool for understanding the evolving relationship between these markets, offering potential benefits for investors, policymakers, and researchers.

The Efficient Market Hypothesis (EMH) suggests that financial markets are efficient and that the connectedness between memes stock and cryptocurrency would be reflected in their market prices, leaving little room for profitable opportunities res

Keywords: Cryptocurrency, meme stocks, meme coins, dynamic connectedness, TVP_VAR model, Volatility, Emerging Markets, Behavioral Asset Theory

Tools: R language, python, Excel

Department: Department of Business Studies

Project Team Members

| Name |

Email |

|

Asma Khalid

|

Asma2019@namal.edu.pk |

|

Arfa Bibi

|

Arfa2019@namal.edu.pk |

Project Poster