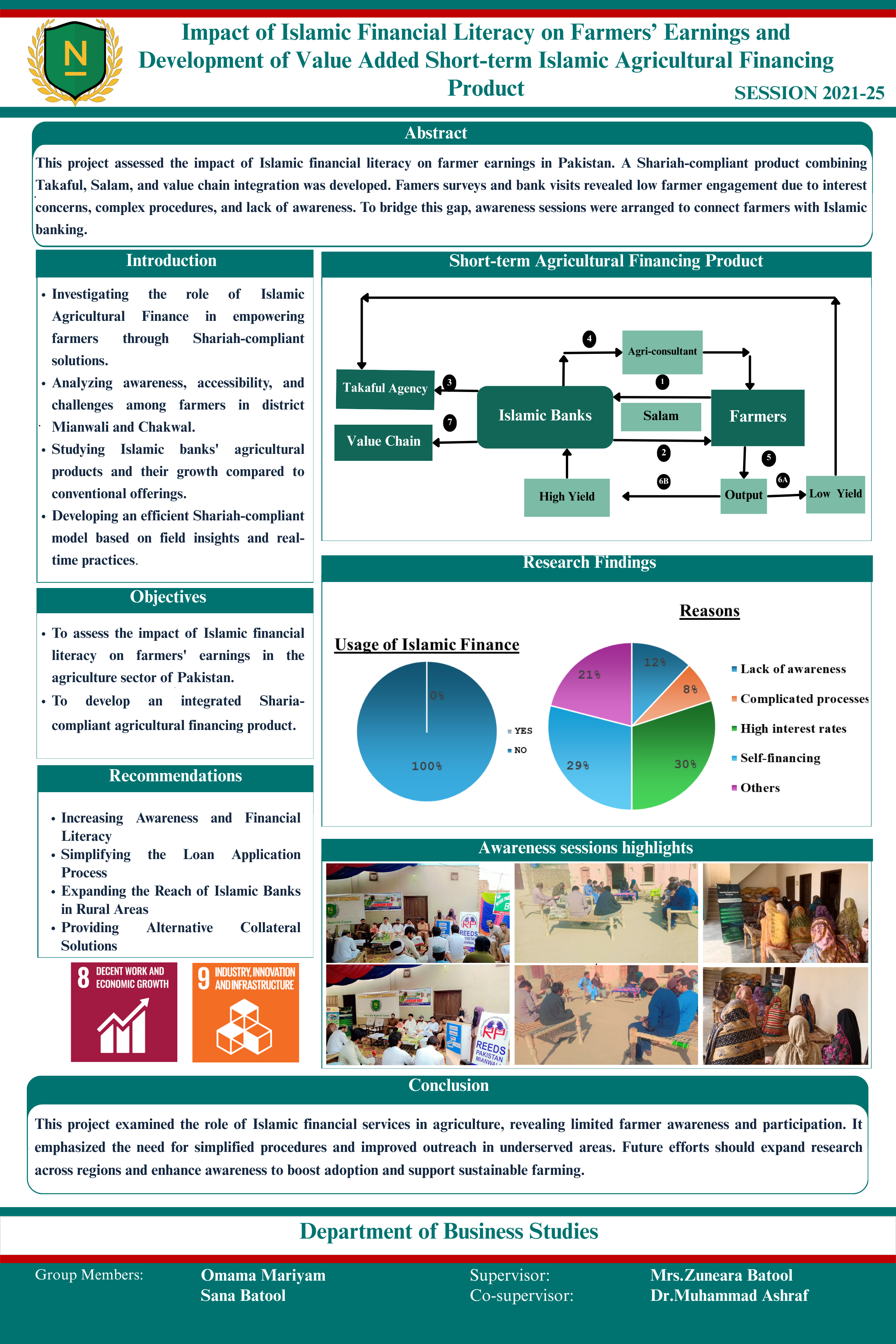

This project explores the landscape of Islamic agricultural finance in Pakistan, focusing on farmer awareness, product accessibility, and the effectiveness of Islamic banking institutions in serving the agricultural sector. Targeting the districts of Mianwali and Chakwal, the research investigates the impact of Islamic financial literacy on farmers’ earnings. Surveys conducted with farmers revealed a significant lack of awareness regarding Islamic banking products and services. To address this gap, awareness sessions were organized to educate farmers about the principles and benefits of Islamic banking. The project developed a Shariah-compliant, value-added, short-term Islamic agricultural financing product. This product integrates Salam with Takaful for effective risk management and incorporates value chain financing to enhance efficiency. The project contributes to increasing financial literacy among farmers while offering Islamic banks a practical, value-based financing solution tailored to agricultural needs.

Tools: Microsoft Office

Department: Department of Business Studies

Project Poster